OKEBRAY: Situs Link Daftar & Login Slot Gacor Oke Bray Tergacor

OKEBRAY adalah situs slot online terpercaya dan tergacor tahun 2025 yang menyediakan link daftar dan login paling aman, cepat, dan mudah. Sebagai platform slot gacor terbaik, Okebray hadir untuk para pecinta judi online yang ingin meraih kemenangan besar dengan RTP tinggi setiap hari. Kami menyediakan berbagai pilihan game slot dari provider ternama seperti Pragmatic Play, PG Soft, Habanero, dan banyak lagi.

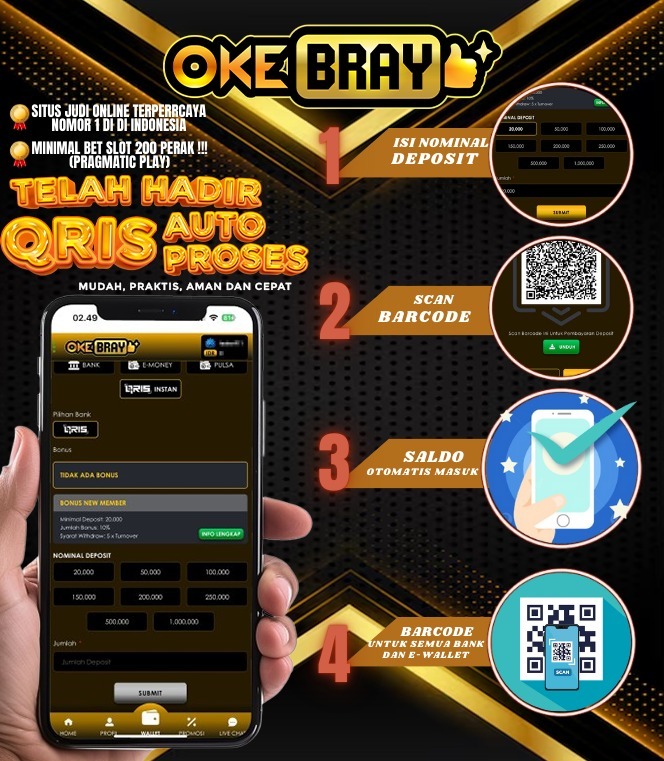

Proses pendaftaran di slot gacor okebray tergacor sangat cepat, hanya dalam hitungan menit kamu sudah bisa login dan mulai bermain. Link resmi kami selalu aktif dan anti-blokir, jadi kamu tidak perlu khawatir soal akses yang terganggu. Selain itu, kami juga menawarkan berbagai bonus menarik seperti bonus new member, cashback harian, hingga free spin gratis setiap minggunya.

Dengan sistem keamanan tingkat tinggi dan layanan customer service 24 jam nonstop, OKEBRAY menjamin kenyamanan dan keamanan setiap member. Kami juga mendukung berbagai metode deposit dan withdraw tercepat, termasuk melalui bank lokal, e-wallet, dan pulsa tanpa potongan.

OKEBRAY bukan hanya soal menang besar, tapi juga soal pengalaman bermain yang seru, adil, dan memuaskan. Desain situs yang responsif dan mobile-friendly memudahkan kamu bermain di mana saja, kapan saja.

Jangan lewatkan kesempatan cuan setiap hari di situs gacor okebray, situs slot tergacor yang sedang viral dan dipercaya ribuan member aktif. Klik link daftar sekarang, login, dan buktikan sendiri seberapa gacornya OKEBRAY. Main di sini, hoki datang sendiri!